Digital ecosystem beyond financial services has a ripple effect on MSME growth

Findings of the Research Team, NeoGrowth Credit Pvt. Ltd.

A popular meme that emerged from the COVID crisis has been the acceleration of digital transformation across all sectors and size of businesses – that which could not be achieved otherwise by all means and in such a short period of time. The pandemic has forced quick decisions and eliminated friction in going digital. As with every business, MSMEs differ in industry, turnover and geographical reach. No matter what the differences were, adoption of digital ways to do business has proven to be a key advantage during this crisis. Digitization and digital tools will help SMEs reduce costs, standardize, and automate business processes and most importantly, be able to do businesses in the pandemic times as well. Many SMEs who pivoted quickly towards a digital delivery model survived, while many others could not stay afloat.

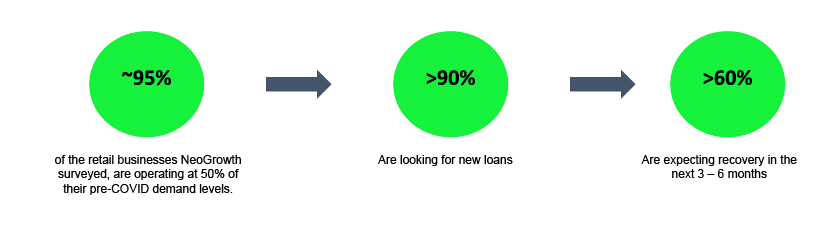

A recent survey conducted by NeoGrowth amongst 10,000+ MSMEs across 25+ cities pan India from May-Sep’20, reflects the journey from survival to consolidation and then towards growth.

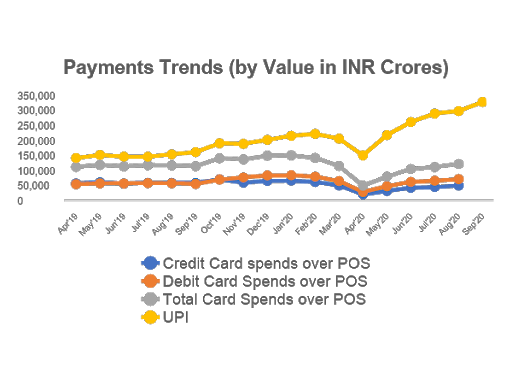

Upsurge in Digital Transactions necessitate the adoption of new age payment modes

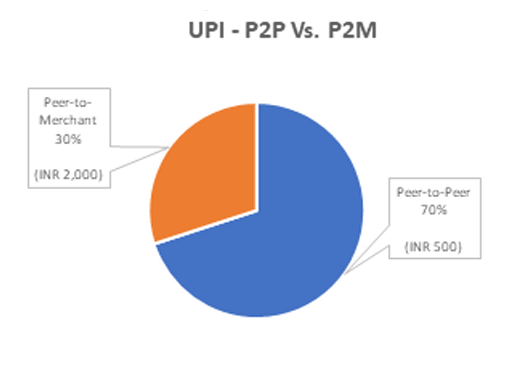

RBI payment statistics released in 2nd week of Oct’20 shows a steady pace of growth amongst digital payments with credit and debit card spends being at Rs. 3,938 crores / day in Aug’20. It is interesting to note that UPI transactions continue to grow post unlocking as people prefer contactless payments for small purchases of essential items. The growth rate of card spends over POS (9% by value/day) has outpaced that of UPI (3% by value/day) in Aug’20 vs Jul’20. However, there is still some way to go to catch up with pre-COVID card spends of around INR 4,909 crores/day in Feb’20. As per NPCI, about 30% of the UPI transactions (by value) are peer-to-merchant. These payment trends clearly reflect the changing consumer behaviour towards contactless payments and the need for small businesses to adopt the digital payment modes.

Enabling digitalization of MSMEs by building an eco-system

Experiencing shutdowns and near-business closures, MSMEs have been responsive towards a digital mode of operating be it creating an online store or listing on an online aggregator platform or tying up with delivery service providers.

This change in behaviour has been validated by an EY survey on Sentiments of India – Pulse of the country, Kiranas, published in June’20.

Also, as per a NeoGrowth Research study, about 40% of retail businesses in apparel, grocery, supermarket, FMCG, consumer durables, spa and salon, cosmetics segments have shown inclination towards going digital.

More and more offline merchants have been adopting digital-first solutions which will play an important role in expanding the merchant acceptance infrastructure in the country. This is where fintech players can facilitate the on-boarding of new merchants. A collaboration with the entire ecosystem will smoothen the digital transformation journey of MSMEs by enabling end-to-end digitization. In the midst of the lockdown, we have witnessed real examples of our neighbourhood kirana stores going online, listing their business profiles and product catalogue on platforms, which have enabled e-commerce opportunities across the cycle of “discovery, order, payment, and fulfillment.”

Enabling easy, secure, and immediate access to funds digitally

With MSMEs contributing around 33% of India’s GDP, their survival and recovery to pre-COVID levels is of paramount importance and requires support of the Government as well as private sector players, including fintech players and digital lenders. Several well-funded start-ups from neo-banking, supply chain technology and bookkeeping segments have aided the MSME digitisation and are now accelerating the digitization of small businesses. These digital ecosystem players have widened and strengthened the scope for alternate data sources based lending for digital lenders like NeoGrowth, Lendingkart, KredX, etc. Building an ecosystem has become essential in current context for enabling lower cost of acquisition, customer retention, availability of data trails for monitoring and underwriting.

Globally, as well as in India, the demand for contactless lending services has gained momentum and is there to remain even when the pandemic is over. Thus, the implementation of automated processes to gain insights into customer’s eligibility and enable rapid origination and processing will become key to success of fintech lenders.

Globally, as well as in India, the demand for contactless lending services has gained momentum and is there to remain even when the pandemic is over. Thus, the implementation of automated processes to gain insights into customer’s eligibility and enable rapid origination and processing will become key to success of fintech lenders.

Moreover, digital disbursement of “Buy Now, Pay Later” type loan products has gained propulsion as micro-credits help in providing relief during cash-crunch of small businesses. With a minimal burden on interest, if repaid within a specific timeframe, digitization of short-term credit processes such as Video KYC will only aid the upsurge in the trend. These micro-credits can be accessed by consumers in less than an hour of virtual e-KYC completion.

With the implementation of Open Credit Enablement Network (OCEN), the lending ecosystem will get democratised further towards a seamless and structured way of sharing data amongst the customers (small businesses), the loan service providers (i.e. of the likes of e-commerce marketplaces / SME enablers) and lenders (including banks, NBFCs, fintech lenders).

Using technology, data, and analytics for ease of doing business

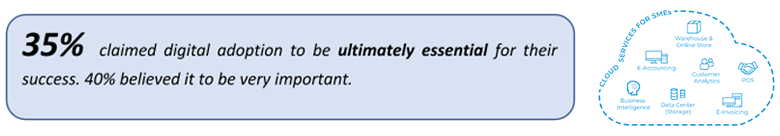

A study titled HP Asia SMB Report – 2020 captured sentiments of SMEs in India, reiterating the importance of adopting technology.

Further, for MSMEs to thrive, they need to have end-to-end digitization of their business operations – business payments, payrolls, reimbursement, and supplier payments. With changing consumer habits in tier 2 & 3 cities, using analytics will aid MSMEs to drive critical business decisions in the future. With increase in digital operations and commerce, there is a need for greater information security, transparency, and protection. With the increasing use of smartphones for business operations, specifically payments, 67% of businesses believe in using data effectively to manage funds, as per the Masters of Balance – 2019 Global eCommerce Fraud Management Report by CyberSource. This accentuates the need for mobile-first payment security solutions to avoid digital fraud risks and boost confidence of businesses going online for first time.

It is indeed a fact that the COVID pandemic has shifted the focus from “purely offline to a mix of online and offline” way of doing business and realigned business models. The role of fintech players, lenders, payment networks, banks, e-commerce and supply chain enablers, marketplaces and social media platforms will be massive for growth of these small and medium enterprises strengthening the digital footprint in the country.